lending club approval process

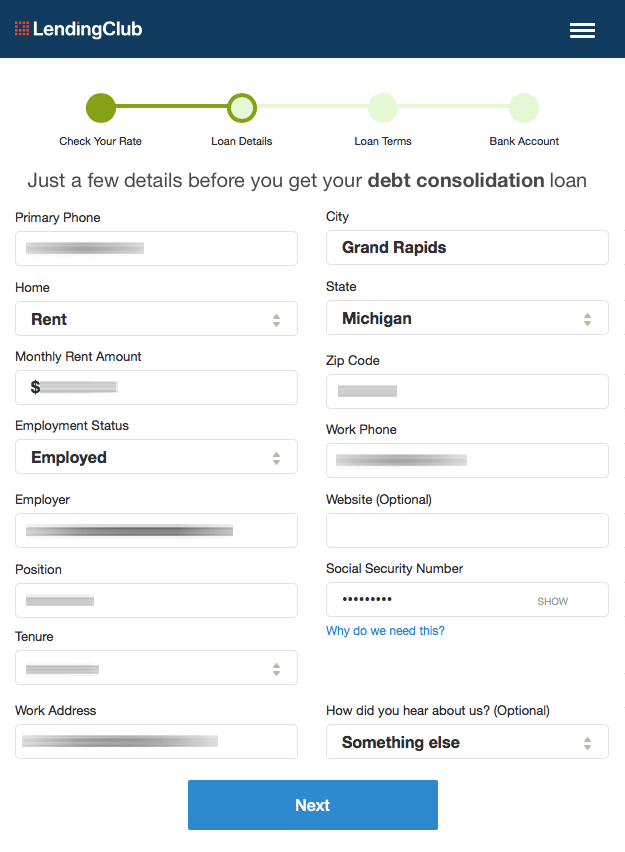

Finish the online application. Our process is fast most members are approved for their loans within a couple of hours.

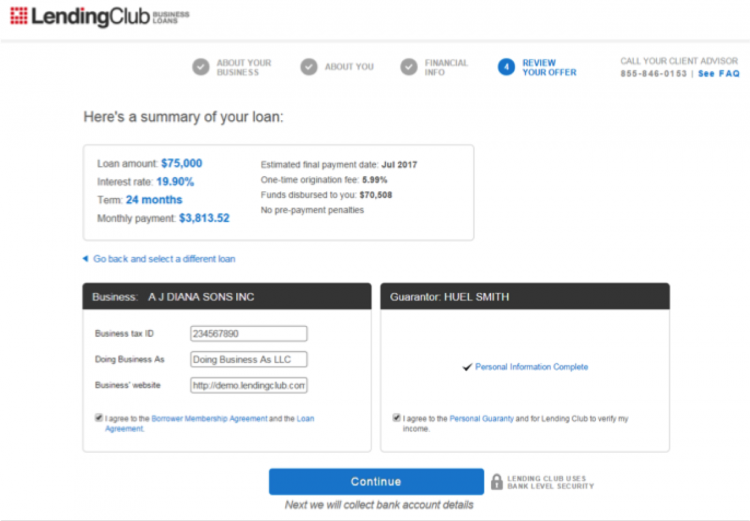

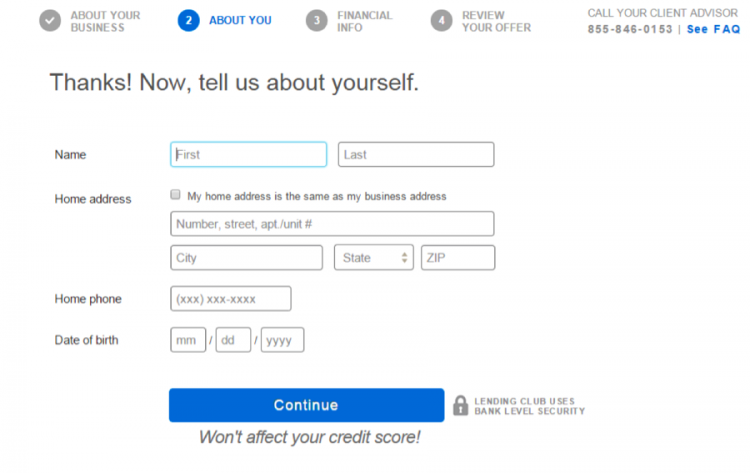

Step By Step Lending Club Business Loan Application In Real Time

The company checks your identity and your financial.

. Preapproval is available through the lenders website and joint. Here is the timeline for my loan application at Lending Club. Lending Club Approval Process - October 2016 I wanted to share my experience with Lending Club and the approval process this past month.

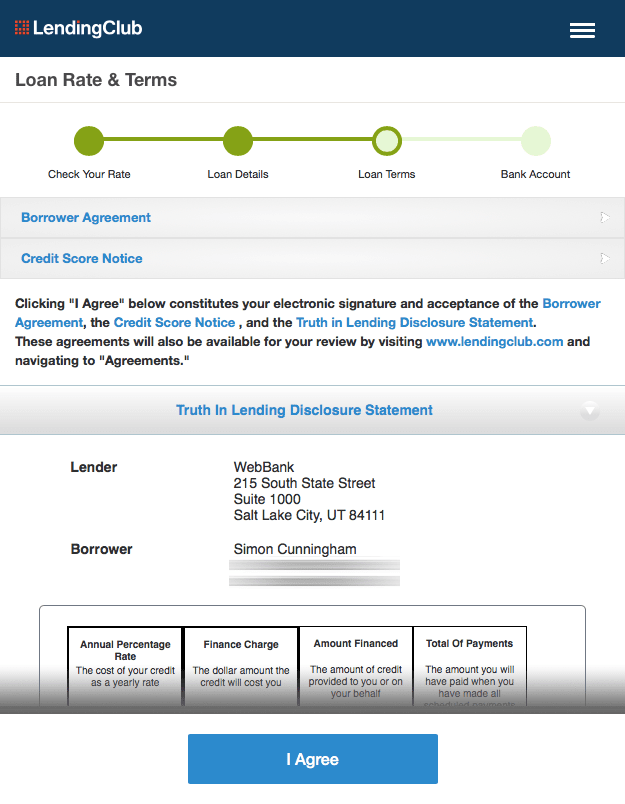

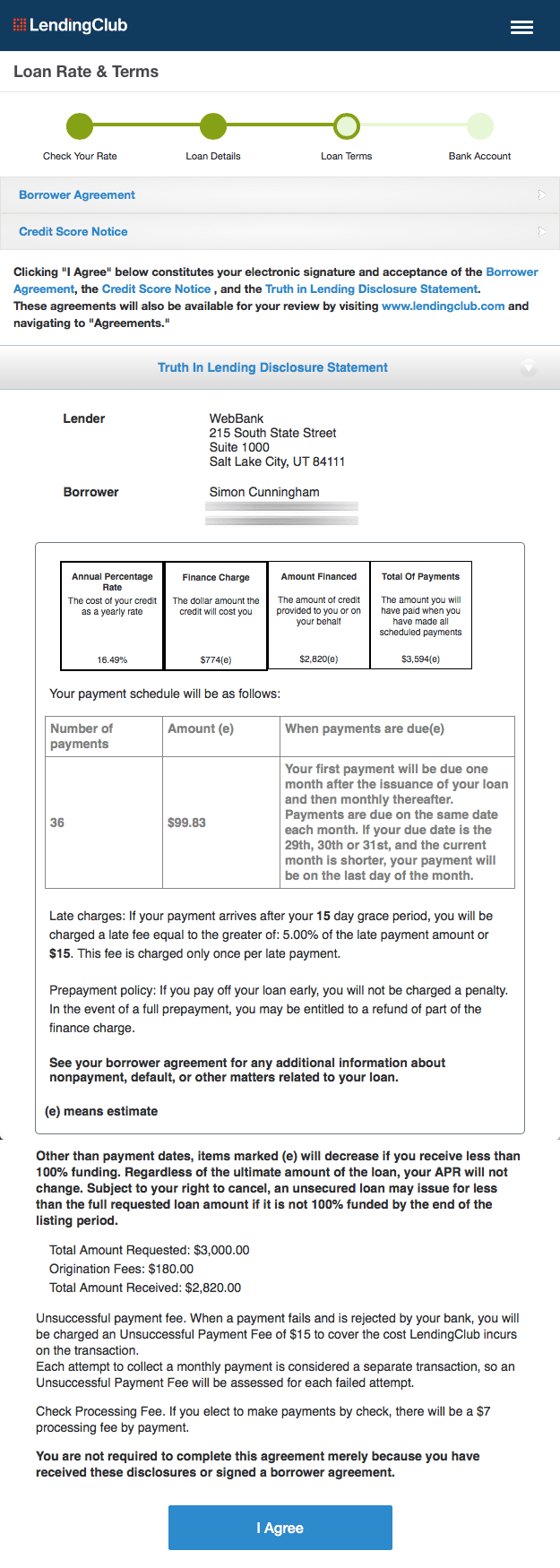

Youll get multiple loan offers if you qualify so choose the one that works best for you. All loans made by WebBank Member FDIC. Unless otherwise specified all credit and deposit products are provided by LendingClub Bank NA Member FDIC Equal Housing Lender LendingClub Bank a wholly owned subsidiary.

You will no longer receive SMS security codes from us until you specifically request a new code via SMS as part of a new login or verification process. Approval documents can be printed by clicking on the PRINT icon under Next Steps in your Practice Center Dashboard. LendingClub is an online marketplace that connects you with lenders.

1 The exact turnaround time youll see for your application will depend on your unique details. Its application process for personal or small business loans is quick and easy. It wont expedite the process but you can help friends family and trusted colleagues get the money.

LendingClub asks for three years of credit history. Your actual rate depends upon credit score loan amount loan term and credit usage history. If you are experiencing issues you can.

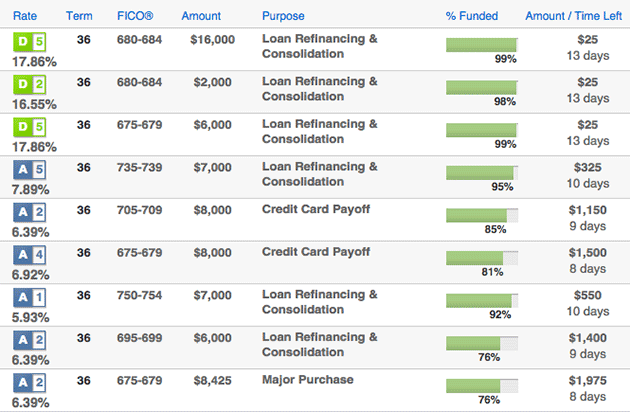

If your loan hits the 60 funding mark Lending Club then begins to verify your personal and financial information. Four Steps to Borrowing from Lending Club Check Your Rate. If Lending Club asks you for documentation or clarification respond immediately.

Once the documents have been printed the print status changes. Be a United States citizen or permanent resident or live in the US on a valid long term. LendingClub Personal Loans Your To-Do List Documents you may be asked to submit Once you submit your application well try to confirm your information on our own.

407 - 735 average historical returns for loan. Confirm your information and review your To-Do List for any outstanding. WalletHub Financial Company.

The Lending Club website asks you to specify the amount of money you are looking to borrow the purpose. How to Apply Qualifying for a personal loan Requirements To borrow from LendingClub Bank you must. The average borrowers debt-to-income ratio is 40.

Wed 914 Loan is active on the platform for investors. Even with all the bad press they. To check for LendingClub pre-approval go to LendingClubs website enter your desired loan amount and the purpose of.

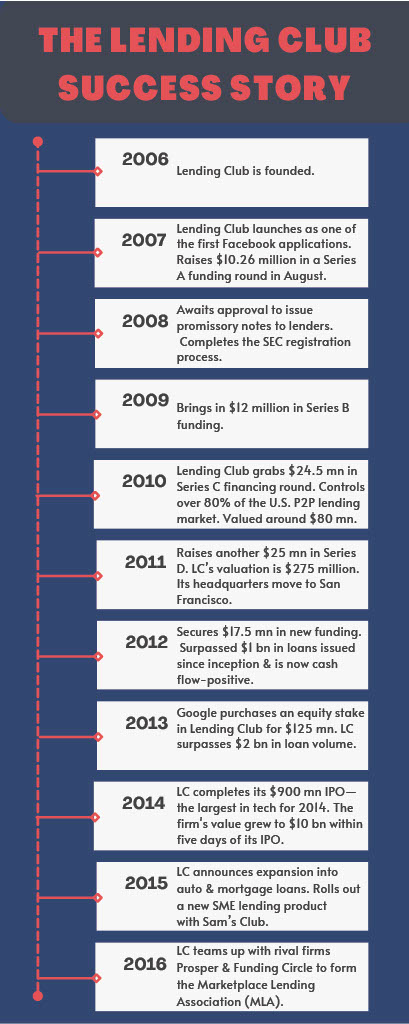

A Brief History Of Lending Club

How To Build An App Like Lendingclub Know The What Why How Code Brew Labs

Lendingclub Personal Loans 2022 Review Moneyrates

Lending Club Offers New Lenders 50 To Get Started On Its Peer To Peer Platform Finovate

Lending Club Review For Borrowers 2019 Is This Company Legit

How Lending Club S Biggest Fanboy Uncovered Shady Loans Bloomberg

Step By Step Lending Club Business Loan Application In Real Time

Lending Club S Impressive Earnings Lure Savvy Investors Thestreet

Lendingclub Personal Loan Review 2022

Why Lending Club Is About To Take P2p Lending Into The Mainstream

Lending Club Review Peer To Peer P2p Lending Explained

Lending Club Peer To Peer Lending 101 For Curious Investors

Lendingclub Personal Loan Review

Lending Club Review For Borrowers 2019 Is This Company Legit

Lending Club Review For Borrowers 2019 Is This Company Legit